Author Archives: Edouard Figerou

Point sur l’impôt sur les plus-values de cession de titres *

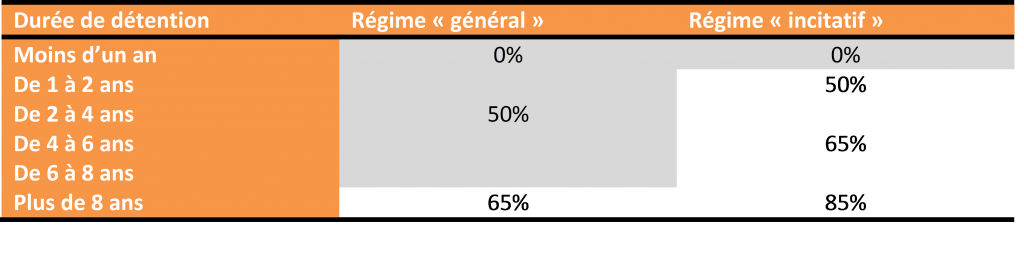

Depuis le 1er janvier 2013, les plus-values de cession de titres sont imposées sans exception soit selon le régime général, soit selon le régime incitatif ;

La durée de détention devient le facteur clé du taux d’imposition :

I – Le régime général

Le régime général et le régime incitatif visent de manière identique les titres sociaux par un dirigeant et les titres détenus par un investisseur, les titres cotés et non cotés, sans aucune distinction.

La durée de détention pour l’application de l’abattement se calcule de date à date ;

La plus-value doit le cas échéant tenir compte de la réduction madelin (article 199 terdecies 0 A) obtenue au moment de l’investissement ;

L’abattement pour durée de détention est applicable aux gains nets : plus-values mais aussi… moins values.

Exemple de détermination du gain net :

ex1: Monsieur X cède en 2013 des titres de son portefeuille de valeurs mobilières et réalise ainsi une PV de 10.000 € sur des titres acquis l’année dernière et une moins-value de 10.000€ sur des titres acquis en 2002 → économiquement il n’a ni gagné ni perdu ; et pourtant fiscalement, il est imposable sur une plus value de 10.000€ sans abattement et pourra déduire une moins value de 3500€ (65% d’abattement), soit une PV nette de 6500€…

ex2: Monsieur Y cède en 2013 des titres fongibles d’une même société qu’il a acquis à des dates différentes :

– Acquisition de 100 titres à 10€ il y a 10 ans

– Acquisition de 100 titres à 30 € il y a 1 an ;

– Vente en 2013 de 150 titres pour 50 € ;

- 2/3 des titres cédés ont été acquis il y a 10 ans et 1/3 des titres cédés ont été acquis l’année dernière (méthode PEPS ou FIFO pour l’application de l’abattement – BOI-RPPM-PVBMI-20-10-20-40, BOI-RPPM-PVBMI-20-10-20-20)

- Abattement de 65% sur 3000€ et pas d’abattement sur 1500 €

II/ Le régime incitatif est applicable dans trois cas :

1) Lorsque le cédant a acquis ou souscrit les titres de l’entreprise dans les 10 premières années de sa création ;

2) Lorsque le dirigeant liquide ses droits à la retraite concomitamment à la cession ;

3) Lorsque la cession est réalisée au sein du groupe familial ;

Ce régime est applicable dès lors que la société émettrice des droits cédés respecte l’ensemble des conditions suivantes :

a) Elle est créée depuis moins de 10 ans et n’est pas issue d’une concentration, d’une restructuration, d’une extension ou d’une reprise d’activités préexistantes. Cette condition s’apprécie à la date de la souscription ou acquisition des droits cédés ;

b) Elle répond à la définition prévue au e du 2ème du I de l’article 199 terdecies-0A (PME au sens européen). Cette condition est appréciée à la date de clôture du dernier exercice précédant la date de souscription ou d’acquisition de ces droits ou, à défaut d’exercice clos, à la date du 1er exercice clos suivant la date de souscription ou d’acquisition de ces droits ;

c) Elle respecte la condition prévue au f du même 2e (aucune garantie en capital)

d) Elle est passible de l’IS ou IR ;

e) Elle a son siège social dans un Etat membre de l’UE ou dans un autre Etat partie à l’accord sur l’espace économique européen (EEE) ayant conclu une convention d’assistance administrative en vue de lutter contre la fraude et l’évasion fiscale ;

f) Elle exerce une activité commerciale, industrielle, artisanale, libérale ou agricole à l’exception de la gestion de son propre patrimoine mobilier ou immobilier :

- Lorsque la société émettrice des droits cédés est une holding animatrice, au sens du dernier alinéa du VI quater du même article 199 terdecies-0 A, le respect des conditions mentionnées au 1° s’apprécie au niveau de la société émettrice et de chacune des sociétés dans laquelle elle détient des participations ;

- Les conditions prévues aux 4° à 8° aliénas du c au f s’apprécient de manière continue depuis la date de création de la société

- En cas de cession des titres reçus en contrepartie d’un apport en sursis (150-0 B), les conditions précédentes s’apprécient au niveau de la holding bénéficiaire de l’apport ;

- En cas de cession des titres en report (150-0 B ter), la PV en report peut bénéficier de l’abattement renforcé si la société apportée remplit les conditions. La PV de cession des titres reçus en échange peut également en bénéficier si les conditions précédentes sont également remplies par la holding ;

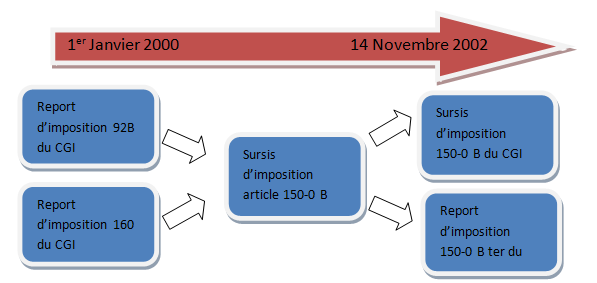

Le report d’imposition établi sur le fondement du II de l’article 92 B du CGI ou du I ter de l’article 160 du CGI, expire également lorsque les titres grevés dudit report font l’objet d’une opération d’apport entrant dans le champ d’application de l’article 150-0 B ter.

Les PV placées en report d’imposition pour lesquelles le report expire à compter du 1er janvier 2013 sont donc imposables au barème progressif de l’IRPP. S’agissant d’une règle d’assiette, les abattements pour durée de détention prévus au 1 de l’article 150-0 D ter ne s’appliquent pas à ces plus-values.

Attention pas d’abattement pour les PV dont le report est antérieur au 1er janvier 2013

L’abattement pour durée de détention ne s’applique pas notamment aux gains nets de cession d’échange ou d’apport réalisés avant le 1er janvier 2013 et placés en report d’imposition.

Pour autant, les PV en report d’imposition par application de l’article 150-0B ter peuvent bénéficier de l’abattement si celles-ci sont réalisées après le 1er janvier 2013.

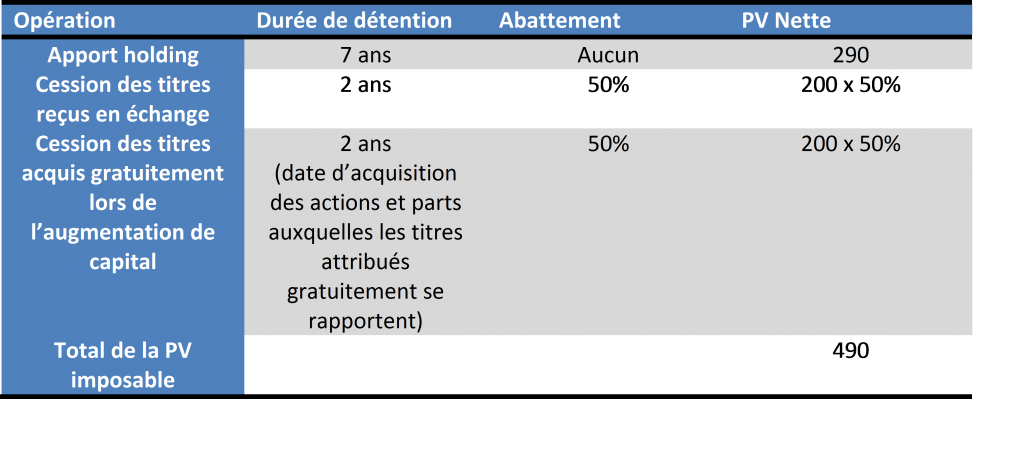

Pour le décompte de la durée de détention :

- Décompte de la durée de détention à partir de la date d’acquisition des titres remis à l’échange (150-0 B, 93 quater, 151 octies),

- Sauf si la PV est placée en report d’imposition dans le cadre du 150-0 B ter. Le point de départ de la durée de détention est la date de l’échange.

- En cas de sursis d’imposition (150-0 B), l’apport est une opération intercalaire qui ne scinde pas la durée de détention (durée de détention unique et continue calculée entre l’acquisition et la cession) ;

- En cas de report d’imposition (150-0 B ter), l’apport fige une 1ère PV tenant compte d’une 1ère durée de détention et en cas de cession des titres reçus en échange postérieurement, une seconde PV sera calculée tenant compte d’une seconde durée de détention.

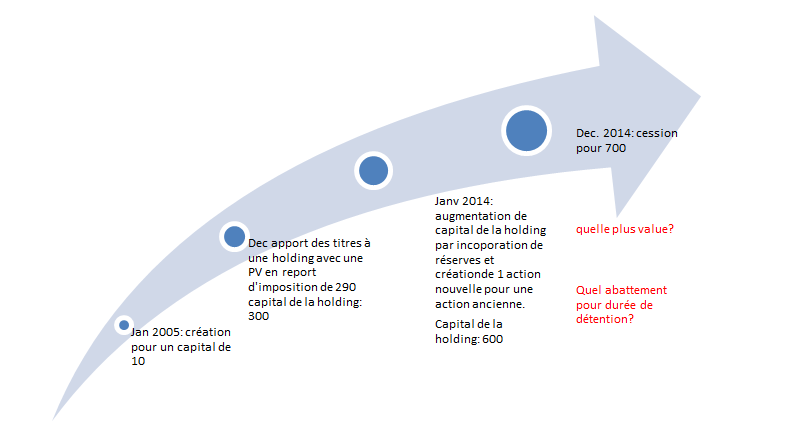

En l’absence d’apport en 2012, la PV aurait été de 690 avec un abattement de 85% (RI) compte tenu d’une durée de détention totale de 9 ans, soit une PV nette imposable de 103,5 (690 x 15%). Le contribuable paiera donc un impôt près de 5 fois supérieur au montant qu’il aurait payé en l’absence d’apport…

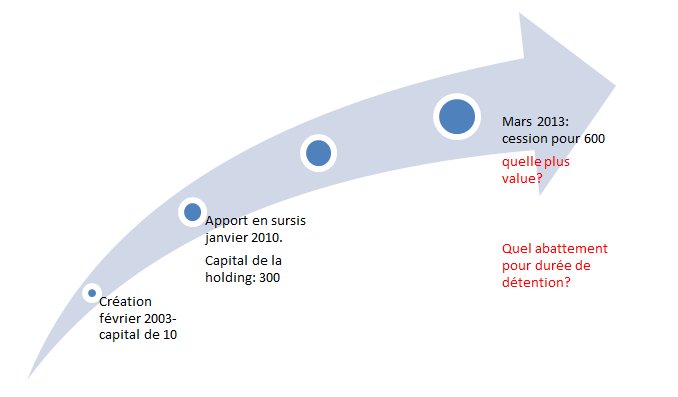

Exemple en cas d’apport en sursis :

La PV est de 590 et la durée de détention est de 10 ans (date de détention des titres remis à l’échange) : l’abattement renforcé de 85% peut trouver à s’appliquer si toutes les autres conditions sont remplies.

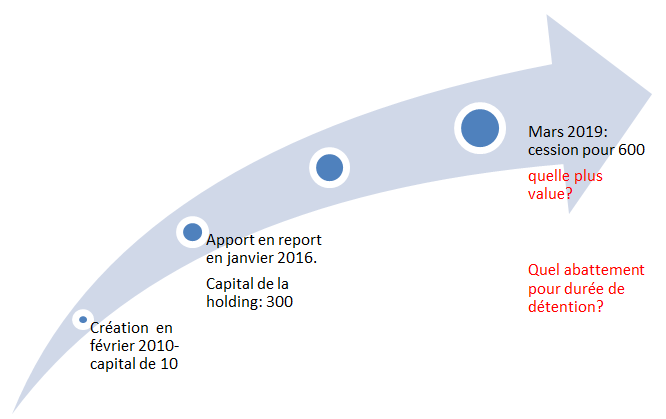

Exemple en cas d’apport en report :

La PV placée en report d’imposition peut bénéficier de l’abattement renforcé mais la durée de détention est inférieure à 8 ans , donc abattement de 65% sur 290. La 2ème PV de 300 peut également bénéficier de l’abattement renforcé mais avec une durée de détention de 3 ans, soit 50% d’abattement. La PV nette après abattement est donc de 251,5 contre 88,5 dans l’exemple précédent (rapport de 1 à 3 environ !).

Départ à la retraite du dirigeant :

Les commentaires administratifs relatifs à l’abattement en faveur du dirigeant de PME partant à la retraite applicable avant le 1er janvier 2014 prévoyaient que les cessions de titres ou droit d’une même société réalisées conjointement par les membres du groupe familial ou par plusieurs cofondateurs pouvaient bénéficier, sous certaines conditions du dispositif de faveur.

Or les commentaires administratifs en consultation publique relatifs au dispositif applicable à compter du 1er janvier 2014 ne reprennent pas ces deux tolérances en faveur du conjoint et des co-fondateurs.

Cession intrafamiliale :

Reprenant l’interprétation antérieure applicable aux cessions intrafamiliale réalisées avant le 1er janvier 2014, les commentaires administratifs indiquent que : « l’abattement pour durée de détention renforcé ne s’applique pas en cas d’apport ou de cession consenti à une société, même de structure familiale, dès lors qu’une telle société est dotée d’une personnalité juridique distincte de celle de ses membres. Une telle opération ne garantirait pas, en effet, le respect de l’obligation de conservation des droits sociaux puisqu’elle permettrait en pratique d’éluder cette condition par le biais d’une cession des titres de la société.

* Source projet de présentation LDF 2015 par CSN et ORDRE DES EXPERTS COMPTABLES

Le rachat de ses propres titres par une société*

Désormais une option fiscale peut se trouver plus avantageuse qu’une distribution de dividendes.

- En cas d’attribution aux salariés ou d’un plan de rachat d’actions (articles L.225-208 et suivants du Code de commerce) ;

- En cas de réduction de capital (article L.225-207 du Code de commerce : « L’assemblée générale qui a décidé une réduction de capital non motivé par des pertes peut autoriser le conseil d’administration ou le directoire selon les cas à acheter un nombre déterminé d’actions pour les annuler ».

- Afin de sortir un associé sans procéder au rachat de ses titres par les autres associés (article L.228-24 du Code de commerce : « Si la société n’agrée pas le cessionnaire proposé, le conseil d’administration, le directoire ou le gérant, selon les cas, sont tenus dans le délai de 3 mois à compter de la notification du refus, de faire acquérir les titres de capital ou de valeurs mobilières donnant accès au capital, soit par un actionnaire ou par un tiers, soit, avec le consentement du cédant, par la société en vue d’une réduction du capital ».

Le 20 Juin 2014 le Conseil Constitutionnel a invalidé le régime hybride imposant, en cas de rachat par une société de ses propres titres, le gain de rachat selon le régime des plus-values sous déduction de la fraction imposée comme un revenu distribué (décision MACHILLOT numéro 2014-404 QPC) ;

L’article 88 de la LFR 2014 aménage désormais le dispositif en généralisant l’application du régime des plus-values à l’ensemble des rachats de titres détenus par des associés à l’IRPP et en prévoyant l’application de ce régime aux titres détenus par des sociétés IS.

Le nouvel article 112, 6° du CGI exclut la qualification de revenus distribués au titre du rachat de titres (le régime du rachat de titres – associé IS):

- Impossibilité pour les sociétés mères de se prévaloir du régime mère-fille

- Application, si les conditions sont remplies, du régime d’exonération des plus-values nettes à long terme sur les cessions de titres de participation.

Le régime du rachat de titres (Associé IR) :

- Application du régime des plus-values sur titres avec application des abattements pour durée de détention (50%, 65%, voire 85%)

- A comparer au régime d’imposition des dividendes avec un abattement de 40% ;

- Risque d’opportunisme fiscal : pouvant être qualifié d’abus de droit.

Le risque d’abus de droit :

- Rachat de l’intégralité des titres d’un ou plusieurs associés par la société suite à un refus d’agrément ⇒aucun risque

- Rachat de l’intégralité des titres d’un ou plusieurs associés par la société pour permettre sa sortie ⇒risque faible

- Rachat de l’intégralité des titres d’un ou plusieurs associés par la société modifiant la répartition du capital à l’issue de l’opération ⇒risque modéré ;

- Rachat proportionnel des titres de tous les associés par la société sans impacts sur la répartition du capital ⇒risque élevé.

*Source projet de présentation LDF 2015 par CSN et ORDRE DES EXPERTS COMPTABLES

Trust in France – Part 3

French Wealth Tax on Trusts

Our first article of this « Trust-Trilogy » started out by stating that in 2011, France defined trusts for taxation purposes only. The article also gave the main terminological basis of trust.

Our second article detailed this new taxation on estate planning (gifts and successions).

In this article we will look at the French wealth tax regime on the taxation of trusts.

Wealth tax (impôt de solidarité sur la fortune, ISF) provisions relating to property or rights held in trust, the sui generis levy due in the event said assets are failed to be declared and the reporting obligations are codified under articles 885 G ter, 990 J, AB 1649 CGI, 1736 and 1754 of the French General Tax code (Code Général des Impôts, CGI),

For more information on the concept of trust, settlor and beneficiary, see part 1 of our Trust Trilogy.

I. When are the assets held in trust subject to wealth tax?

A) Two types of trusts are excluded from wealth tax

- Trusts whose beneficiaries are all qualified as charitable organizations

Said trusts must be irrevocable and the trustee must be subject to the law of a State having concluded with France a double tax treaty to combat tax fraud and tax evasion.

In such cases the assets placed in trust are not to be included in the taxable base for wealth tax. - Trusts settled by French residents specifically for retirement purposes are also excluded from this tax.

B) French territoriality rules

The principle of the current legislation is transparency.

Article 885 G ter of the CGI stipulates that property and rights placed in a trust, including their capitalized revenue, are taxable for wealth tax in the grantors name, as if they had never left his estate.

This rule makes the tax base irrelevant to the contents of the trust deed and thus the nature of the contract (whether it be revocable, irrevocable, discretionary or not).

Under France’s own rules (article 750 ter of the CGI), subject to international tax treaties (BOI-PAT-ISF-20-20), are subject to wealth tax:

- The assets or rights placed in trust whose settlor or beneficiary that has become settlor are a tax residents of France, and thus regardless of where said assets or rights are situated, be it in France or abroad;

- The assets or rights (excluding the financial investments referred to in Article 885 L of the CGI) situated in France having been placed in trust by a settlor or a beneficiary that has become settlor who are not tax residents in France.

When assets held in trust are subject to wealth tax they are taxed under the ordinary rules on wealth tax (scope, tax base, exemptions).

Thus, to give an example, taxpayers whose net fortune exceeds the threshold of ISF who have not been French tax residents during the five years preceding the year in which they become a French tax resident are only liable for wealth tax on the assets placed in trust that are situated in France; and this until December 31st of the fifth year following the year in which they have established their tax residence in France.

Reminder: the financial investments as defined under article 885 L of the CGI include all investments made in France by an individual and whose revenue of all kind, except capital gains, fall or will fall within the category of investment income (‘revenus de capitaux mobiliers’).

Are mainly concerned cash and term deposits in euros or currency; shareholder’s current accounts held in a company or a corporation that has in France its headquarters or place of effective management; bonds and bills of the same nature, bonds, shares and subscription rights issued by a company or corporation that has its headquarters in France or the centre of its effective management, life insurance policies or endowment contracts signed with insurance companies established in France.

However, are not considered financial investments:

- shares representing sufficient influence in a company (in practice, are presumed equity securities, investments representing at least 10% of the capital of a company ; this threshold is judged globally at the level of the trust);

- shares held by non-residents, in a French or foreign company/corporation, whose assets are primarily made up of real estate or rights in immovable property situated on French soil, in the proportion of the value of said property or rights in relation to the total assets of the company (second subparagraph of Article 885 L of the CGI);

- shares owned more than 50% by non-residents (directly or indirectly owned) in corporations or organizations that own real estate or real estate rights in France (second subparagraph of Article 885 L of the CGI).

C) The impact of international tax treaties

The internal French rules seen above are subject to the provisions of international tax treaties, since Article 885 G ter of the CGI falls under the scope of double taxation avoidance where income and wealth tax are concerned.

Therefore in cases where double taxations are characterized, i.e. when a same person is subject to wealth tax in more than one State, double taxation avoidance rules are applied.

When the taxpayer is a French resident, the tax paid abroad is deducted from the French tax due. However the taxpayer must prove he/she actually paid foreign tax.

II. When the assets held in trust are subject to the sui generis levy

The main purpose of the new sui generis levy on trusts is to sanction the non-disclosure of assets placed in trust in respect to wealth tax.

This levy is not subject to the provisions of international conventions on double taxation avoidance with respect to income and wealth taxes.

A. Exclusion of two categories of trusts

By law two categories of trusts are excluded from the sui generis levy’s scope:

- Irrevocable trusts whose sole beneficiaries are covered by Article 795 of the CGI and whose trustees are subject to the law of a State or territory who has concluded with France a double taw treaty on double tax avoidance.

- Some trusts set up to manage pension rights.

B. Liable taxpayers

The taxpayers liable to the statutory levy owed on trusts are the settlors and the beneficiaries deemed to have become settlors.

C. The tax base

The base of the levy is made up of:

- All assets and rights placed in trust whether they are situated in or outside France, including their capitalized income for the people who reside in France for tax purposes;

- The assets and rights placed in trust and situated in France, including their capitalized income (other than financial investments under Article 885 L of the CGI), for people who are not French tax residents.

In the case where several beneficiaries are also the settlors of the trust and in the absence of express distribution of assets in the trust deed or any additional annexes, the assets of the trust will be deemed equally distributed between each of them.

The base of the levy, as wealth tax, is set on the net market value of the assets, rights and capitalized income contained in the trust on January 1st of the tax year.

The sui generis levy rate corresponds to the highest rate of wealth tax.

D. Exemption of assets, rights or products properly declared to wealth tax or who fall under section 1649 AB of the CGI

The levy is not payable in respect to assets, rights and capitalized income:

- Included in the scope of wealth tax of a settlor or beneficiary having become a settlor liable to wealth tax and having declared and paid his/her tax properly. In this regard the non-declaration of assets or rights due to their exemption does not make them subject to the levy; this also applies to assets non-declared in accordance with tax treaties.

- that appear on the specific statement related to trusts under section 1649 AB of the CGI, when the assets of the settlor or the beneficiary having become settlor falls below the wealth tax threshold.

The net value of the estate taken into account includes the assets, rights and capitalized income placed in trust.

The exemptions applicable for wealth tax, including those relating to the nature of certain assets (business assets, shares subject to lock-up, art …), do not apply.

E. The recovery of the sui generis levy

The levy must be paid by the trustee.

The trustee, the settlor and the beneficiaries, other than those having satisfied their own reporting obligations, and their heirs, shall be jointly and severally liable for payment.

The levy follows the same rules and penalties of those applied in the matter of death duties.

III. Tax reporting obligations

Two tax reports must be filed.

Firstly, a « factual » statement following the creation, modification or extinction of a trust, said statement contents the content of the trust.

And on the second hand, an annual return containing the net market value of the assets and rights held in trust and their capitalized income on January 1st of that tax year.

Penalties for non-compliance of reporting requirements

Breaches of reporting obligations are exposed to a fine of 10.000 € or, if higher, an amount equal to 5% of the total value of the assets, rights and capitalized income situated in and outside France, that are placed in trust.

TRUST – Part 2

Trust & estate planning

As you may recall our first article of this « Trust-Trilogy » started out by stating that in 2011 France defined trusts for tax purposes only. The article also gave the main terminological basis of trust.

Today let’s take a more detailed look at the new tax implications on your estate planning.

A./ Which transmissions are subject to tax?

All gratuitous transmissions, gifts/inheritances made via a trust are now subject to transfer duties. In France gift tax and inheritance tax both fall under the global denomination of ‘droits de mutation à titre gratuit’, also known as ‘DMTG’ for short.

The granted assets, including the income of capitalized assets placed in trust, are taxed at a net market value on the date of the transfer (i.e the date of the gift or upon death of the grantor).

B./ Which assets are subject to tax?

1. French territoriality rules

Article 750 ter of the French Tax Code (Code Général des Impôts or CGI for short) defines French territoriality rules in the event of a gratuitous transfer.

It is necessary to point out that French transfer duties apply, subject to double tax treaties.

In the event the settlor, or the beneficiary (who is also the settlor), are non-French tax residents transfer duties are due:

– On all the assets and rights held in trust, regardless of the country of their location, when the beneficiary is resident in France on the day of the transmission and has been for at least six years in the last decade;

– Or solely on the assets and rights held in trust that are located in France in all other cases.

2. The impact of international tax treaties

International tax treaties provide mechanisms to eliminate double taxation. Where inheritance and gift taxes are involved the right of taxation between the two States involved is based on two criteria: the location of the assets, or the State of domicile of the deceased, the donor or the heir.

Therefore when the assets held in trust are transferred in the cases foreseen by Section II, article 792-0 bis of the French Tax Code, the presence of the trust has no impact on the application of international double tax treaties where inheritances and donations are concerned.

When a juridical double taxation is revealed, that is to say when one person is taxable on the same property by more than one State the terms of elimination provided for by the conventions are applicable under the general conditions of common law.

In such a case, when France is the country of residence the tax paid abroad is due subject to the limit of the tax due in France. It is the responsibility of the taxpayer to prove payment of the foreign tax.

3. Presumption of ownership

The presumption of ownership foreseen by article 752 of the French Tax Code has been expressly extended to assets and rights held in trust.

Therefore the status applicable to securities has been extended to assets or rights held in trust to which the deceased had ownership, received income or performed any operation in relation to less than a year before his death.

Said assets or rights are presumed to be part of his estate, until proven otherwise.

C./ Obligations regarding tax returns

In the event of a gratuitous transfer of assets or rights held in trust, including the income of capitalized assets, they shall be reported on the general forms corresponding to their nature, i.e a « declaration de succession ou donation ».

These are the basic relevant forms filed upon death or after a gift.

D./ Terms of taxation

1. The transmissions qualified as gifts or as transmissions by death

The transferred assets, including their capitalized revenue will be taxed at their net market value at the date of the transfer under conditions of ordinary law. The tax rate will be that corresponding to the family tie between the grantor and the beneficiary.

If the grantor and the beneficiary were husband and wife or tied by a civil partnership the transmission upon the grantor’s death will be free of tax pursuant to article 796-0 of the French Tax Code.

2. The other types of transfers

The grantor’s death entails new taxation, whether the estate is transferred upon his death or whether it is foreseen for a later date.

a) The transmission of a determined share to an identified beneficiary

When the share is defined at the date of death transfer fees (death duties) are applied to said share and the tax rate is that corresponding to the family tie between the grantor and the beneficiary.

Thus for the liquidation of death duties the value of the assets, properties and rights held in trust and transferred upon death is added to the value of the rest of the estate.

Basically general taxation rules apply here. Equally the same rules of exemptions also apply. For example the exemptions foreseen by article 795 of the French Tax Code, that deals with transfers in favor of philanthropic organizations, apply.

b) The transmission of an overall share to one or several of the grantor’s descendants

Here we are faced with a situation where even though the share is defined at the time of death and globally is destined for all of the grantor’s descendants, it is not possible to share it individually between them.

In this case death duties are due on said share at the top marginal rate applicable in the direct line of lineal descent (said rate was increased to 45% for inheritances since July 31st 2011 by article 6 of the First Amending Finance Act of 2011, No.2011-900 of July 29th 2011) and no allowances are granted.

c) All other case transfers

This third case reflects in practice the following assumptions:

– Either the assets or rights remain held in trust after the grantor’s death without being attributed,

– Or the share, that is not individually defined, is attributed to several beneficiaries, some of which are not the grantor’s descendants.

In these situations taxation will occur at the highest rate of the installment table III of article 777 of the French General Tax Code.

Let’s take an example:

The grantor of a trust who is a French non-tax resident dies on January 10th 2012. In 2010 he created three trusts whose characteristics are as follows:

– Trust A: a revocable trust whose beneficiaries are the grantor and one of his two sons. The son is a French tax resident;

– Trust B: a discretionary irrevocable trust whose beneficiaries are the two sons of the grantor, both of which are French tax residents;

– Trust C: a discretionary irrevocable trust whose beneficiaries are for half the two grandsons of the grantor « alive on the 1st of January 2015 ».

The trustee of the trust retains full discretion to dispose of the other half of said trust.

The grantor’s death entails the following tax liability:

– Death duties on the net value of his whole estate which comprises the net value of trusts A & B,

– Death duties on the net value of trust C: at a rate of 45% on one half due to the fact the number of the beneficiaries was not defined (« grandchildren alive on January 1st 2015 ») & at the rate of 60% on the balance.

E./ Summary of the different hypothesis’s of taxation

| The nature of the transfer | Taxation |

| Death or donation/gift | Death duties are due at a rate dependent on the degree of relationship with the deceased |

| Neither death nor donation:

– The share and the beneficiary are determined – The share is determined but it is destined globally to several descendants of the grantor – other cases: * the trustee of the trust falls under the law of a non co-operative State or Territory ; or the grantor was domiciled in France when he created the trust after May 11th 2011 *Assets remain placed in trust after the grantor’s death without having been attributed |

Death duties are due at a rate dependent on the degree of relationship with the deceased

45 % 60 %

60 %

60 % |

In our third and final article we will take a look at the wealth tax issues related to trusts.

Exit tax

Leaving France?

Be cautious, you may be subject to exit tax on your intangible personal property…

In 2011 an exit tax was put in place to curb tax relocations before the disposal of financial investments. Amended in 2014, the taxpayers concerned are those transferring their tax residence outside France as of 3 March 2011.

Exit tax system

When a taxpayer was a French tax resident for at least six of the ten preceding years, and transfers his/her tax domicile abroad this entails tax and social security contributions on:

- unrealized gains arising on:

- either direct or indirect investments, of at least 50% of the share capital of the company,

- direct investments in one or more companies (including OPCVM’s/UCITS), whose total value exceeds € 800,000

- deferred capital gains,

- claims on an earn-out payment.

Are not subject to exit tax:

- gains realized on real estate,

- shares of open-ended investment companies (SICAV) ;

- shares or securities of companies predominantly comprised of real estate (including SCI’s) ;

- shares or securities referred to in article 244 bis A, I-3 of the French general tax code (CGI), particularly:

- shares, securities or other rights of unquoted real estate companies, whether said companies are subject to corporation tax or not,

- and shares, securities or other rights of real estate listed companies when the taxpayer owns directly or indirectly at least 10% of the company’s capital.

And many more…

Tax-deferral

A tax-deferral is automatically granted when the move is made to a member state of the European Union or a State that has concluded a tax assistance agreement with France. And if the move is made to another country, the taxpayer may request a tax-deferral providing certain financial safeguards are ensured.

Said tax-deferral is then terminated upon sale, redemption, or repayment of the respective securities.

Retention period

Capital gain tax is relieved or can be recovered if the taxpayer proves he/she still owns the investment(s) after a period of eight years after the move abroad. However social security contributions remain due.

For all moves abroad after December 31st, 2013, capital gains tax and social security contributions are exempt or refunded if the taxpayer can prove he/she still owns the investment(s) after a period of fifteen years after the move abroad.

Investment of shares subject to exit tax in a new company

Before doubts existed when it came to the tax neutrality of such a transfer.

New article 167 bis of the CGI provides us with clearer wording: the investment of securities, subject to exit tax after departing France, does not terminate tax-deferral when said deferral was granted under the conditions of article 150-0 B of the CGI (contribution of shares in a company subject to corporation tax, « offre publique », merger, division …) or postponed under article 150-0 B ter of the CGI (contribution to a company controlled by the contributor).

Gift of shares subject to exit tax

The law in place up until 2013 provided that a donation of shares subject to exit tax entailed the end of tax-deferral, unless the taxpayer could prove the gift was not solely granted for tax purposes only.

On July 12th, 2013, the French Conseil d’Etat judged that this requirement was contrary to the freedom of establishment within the European Union (case N° 359995).

The law was therefore amended: a taxpayer leaving France to settle in a European Union member country (or a country in the European Economic Area which has entered into a tax agreement with France) has no longer to prove the non-tax purpose of the donation.

However, the probationary requirement is maintained for those who leave to settle in another state and said requirement has even been made heftier: the taxpayer must demonstrate that the gifts main motivation was not to evade exit tax.

Double-taxation avoidance

When a taxpayer sells investments subject to exit tax after leaving France, and pays relevant capital gains tax in his/her new state of residence, the foreign tax is deducted in France as follows:

- First of all the foreign tax is deducted from the social charges resulting from the exit tax,

- Secondly the remainder shall be credited against the income tax resulting from said exit tax.

Depreciation of the shares

In its initial version article 167bis of the CGI adapted exit tax to the effective gain made by the taxpayer transferring his/her tax resident outside France.

From now on, the text also allows to deduct the realized loss on a sale of securities subject to exit tax on the capital gain realized on the sale of other securities subject to exit tax. Said deduction is allowed on the sale of investments representing more than 25% in a French company or on future capital gains achieved after returning to France.

Equally, a capital loss realized before, or after leaving France on the sale of securities representing over 25% in French companies is deductible from any exit tax relating to investments sold within 10 years.

Tax reporting obligations in the event of exemption or refund

The taxpayer must now declare the nature and date of the event triggering an exemption or refund of exit tax and, on the same occasion, expressly request relief or restitution. This claim must be made within the year of said event and within the period stipulated in article 175 of the CGI (deadline for tax returns).

For more details on your tax reporting obligations upon departure, and then on a yearly basis; or if you have any question regarding penalties in case of non-compliance please do not hesitate to contact us.

Guide juridique et fiscal de la Pharmacie

Vous pouvez demander Le Guide juridique et fiscal de la Pharmacie à l’intention des pharmaciens et des officines, co-rédigé par l’office.

Disponible sur demande directement auprès de Maître Edouard FIGEROU (e.figerou@notaires.fr)

« Des prix encore à la baisse en 2015 », Pierre Luc Vogel

Pierre-Luc Vogel, Président du Conseil supérieur du notariat, était l’invité du Club Immo mardi 16 décembre.

Interviewé par Olivier Marin, Pierre Luc Vogel a livré ses analyses sur la Réforme de la profession, l’état du marché, l’évolution des prix et du volume de ventes immobilières…

New measures for non-French resident taxpayers on their French income

The French administration currently applies specific measures for non-French residing taxpayers on their income of a French source.

Currently said measures, that are thought to be unjust, are under the spotlight of the European Commission and the European Court of Justice.

2015 may bring advantages for non-residents, and claims for unrightfully paid tax may be filled for 2012 and 2013 – but you must act quickly!

Let’s take a look.

- Harmonization of capital gains tax rate for non-residents

Up until now taxpayers were treated differently dependent on their state of residence.

French residents, EU and EEA residents were taxed at a rate of 19%, whereas non EU/EEA residents were subject to a higher rate of 33,33%.

After the French Supreme Court (Conseil d’État) rendered a decision mid October 2014 highlighting this difference, judged as restrictive of the free movement of capital, the 2014 Amended Finance Bill changed article 244 bis A of the French General Tax Code.

Rates are now harmonized for residents and non-residents at the flat rate of 19%, however taxpayers of NCST’s (Non-Cooperative State or Territory) remain excluded.

Note: Even though it is not clearly expressed this situation is believed to cover not only individuals selling properties directly but also those selling properties via SCI’s.

Reclaim: For any overpaid tax in years 2012 and 2013 you may place a claim to the French tax authorities before the end of this year.

- Reclaim on social contributions paid by non-residents

Since August 2012, non-French tax residents have been made liable for the social contributions on French income, i.e capital gain or rental income.

For example previously, such taxpayers were merely liable for capital gains tax, and since August 2012 the basic gross tax rate for EEA residents has been 34.5%.

However a case is currently pending before the European Court of Justice (Aff C-323/13 – Mr de Ruyter), whereby the application of French social contributions to non-residents may be put an end to.

They are considered contrary to the EU principle of free movement, and unjust due to the fact that non-residents do not benefit from French social protection.

France may be condemned to reimburse some 344 million euros for the year 2012.

Reclaim: Even though the CJEU has not rendered its decision yet, EU residents who paid social contributions in France on rental income or on the sale of their property should be able to claim back the amount paid from the French tax authorities.

For social contributions paid on capital gains taxpayers can make a claim up to the 31st of December of the year following the year in which the contributions were paid (Decision of the Administrative Court of Paris).

For tax paid in 2012 the deadline would have been the 31st of December 2013, and for tax paid in 2013 the deadline is the 31st of December 2014. However for 2012 and without any guidelines from the French administration it is believed claims could still be made before the end of 2014 to ensure any chance of recovery.

- Announcement to suppress tax representatives

Non-French tax residents subject to French income must currently, under certain circumstances appoint a tax representative who will be jointly liable on said tax until its prescription date.

Some legal entities were granted licenses by the French administration as professional tax representatives. However their services came at a price, a price French tax-residents did not have to pay.

Portugal was condemned on this front by the European court in 2011.

In anticipation of a French condemnation and to comply with the law of the European Union, French amending Budget Act for 2014 proposes to remove the requirement for resident taxpayers in the European Union, and in some cases in the European Economic Area (EEA) to appoint a tax representative in France.

This follows a formal request sent to France from the European Commission to cancel this legislation.

From January 1st 2015 tax representatives for capital gains in France is likely to be canceled for taxpayers residing in the EU or in the EEA.

However we must await the final adoption of the law.

The same suppression is also implemented for income tax, wealth tax, corporate tax and the 3% tax.

A lot to take into consideration – if you need guidance please seek our advice.

Allégements des normes d’accessibilité aux handicapés pour les hôtels, commerces et parkings

Assouplissements apportés par un arrêté du 8 décembre 2014

Un arrêté du 8 décembre 2014 modifiant le Code de la construction vient assouplir les dispositions d’accessibilité aux personnes handicapées des établissements recevant du public, situés dans un cadre bâti existant et des installations existantes ouvertes au public.

Les constructions neuves ne sont pas concernées.

Ces normes techniques seront applicables à compter du 1er janvier 2015.

L’objectif visé est double :

– simplifier les exigences de la construction annoncées par le ministère du Logement,

– réduire les coûts de la construction qui ont considérablement augmenté au cours de ces dernières années.

Hôtels et commerces

Les allègements principaux concernent les points suivants :

- Les cheminements extérieurs

Dès lors qu’une entrée principale ne peut pas être rendue accessible, l’accessibilité d’une entrée dissociée peut être envisagée dès lors qu’elle est signalée et ouverte à tous en permanence pendant les heures d’ouverture.

- L’accès à l’établissement où a l’installation

Pour les bâtiments dont l’entrée comporte un dénivelé une possibilité est offerte d’adopter comme aménagement une rampe « amovible, qui peut-être automatique où manuelle » et non plus uniquement une rampe fixe.

- Circulations intérieures horizontales

L’arrêté assoupli également certaines normes de dimensions en matière de cheminements et de circulations.

Les largeurs de passage des allées de circulation principale – menant aux caisses, sanitaires ou cabines d’essayage – pourront faire 1,20 mètre au lieu de 1,40 mètre et les largeurs de portes pourront être de 80 cm au lieu de 90 cm dans le neuf, etc.

- Circulations intérieures verticales

Les hôtels non classés ou classés une, deux ou trois étoiles et qui n’ont pas plus de trois étages en sus du rez-de-chaussée, sont exonérés de l’obligation d’être équipé d’un ascenseur, dès lors qu’ils offrent des chambres adaptées aux handicapés, accessibles au rez-de-chaussée.

Parkings

Désormais dans les parkings souterrains ou aériens, les places de stationnement adaptées et réservées aux personnes handicapées pourront être « concentrées sur les deux niveaux les plus proches de la surface », et non plus réparties sur tous les niveaux.

_________

Les dispositions sont bien plus nombreuses, nous n’avons repris ici que certaines mesures emblématiques.